LGE is closed Tuesday, December 24 at 1 p.m. ET and Wednesday, December 25 in observance of Christmas.

Security Tips & Alerts

What are trigger leads, and can I avoid them?

Trigger leads occur when credit bureaus sell your information to third parties (like lenders) whenever your credit file is accessed, such as during a mortgage or loan application. This often results in a flood of unsolicited offers from competing lenders. While trigger leads are legal and intended to help provide you with competitive offers, you can take steps to protect your privacy.

How do trigger leads affect me?

Frustration & Confusion: The influx of offers can be overwhelming and sometimes misleading, making it difficult to identify genuine opportunities.

Increased Risk of Identity Theft: With your information circulating among multiple parties, there’s a heightened risk of identity theft and fraud.

How can I opt out of trigger leads?

Opt-Out Directly: Contact Equifax, Experian, and TransUnion to opt out of pre-screened credit offers.

Online Opt-Out: Visit OptOutPreScreen.com to register online. It takes about five days to process.

Permanent Opt-Out: For long-term protection, consider a permanent opt-out. Also, register on the National Do Not Call Registry to stop unwanted calls—just be sure to do this at least a month before applying for a loan.

How does LGE take care of my privacy?

We prioritize your privacy and DO NOT SELL your information to third parties – we only share details with disclosed parties as per our privacy policy. For more information, visit our Privacy Policy on our website or reach out directly with any questions.

Stay informed with the Filing Activity Notification System (FANS)

FANS notifies individuals when their personal information, like their name or address, is used to file deeds or other property records in Georgia. These notifications can help you catch potential scams like deed fraud before it’s too late.

Learn more about property transfer scams and sign up for FANS today.

Text Message Scam Alert

We’ve recently been made aware of an increase in fake text messages claiming to be from LGE and asking the recipient to click a link.

If you receive one of these texts, do NOT click the link.

Instead, forward the message to SPAM (7726) for the carrier to investigate.

iPhone users can also swipe on the text message to delete and when prompted, select “Delete and Report Junk” to report the message to both Apple and the carrier.

03/05/2024

People are losing big money to scammers running complicated scams. The scams usually involve someone supposedly spotting fraud or criminal activity on one of your accounts, offering to help “protect” your money, sometimes asking you to share verification codes, and always telling you to move money from your bank, credit union, investment, or retirement account. And every bit of it is a scam.

To help protect people you care about, and their life savings, share this advice on how to stop these scammers in their tracks.

Never move or transfer your money to “protect it.” Your money is fine where it is, no matter what they say or how urgently they say it. Moving it means you’ll lose it, not protect it. Someone who says you have to move your money to protect it is a scammer. Period.

Never share a verification code. Ever. Credit unions use these codes in online banking to prove you’re really you. If you share that code, the scammer can use it to prove they’re you. No caller — especially someone from the credit union’s fraud department — will ever ask for the verification code. That’s always a scam.

Stop and check it out. If you’re worried, call LGE at 770-424-0060. Always use the number you find on your statement — never the number the caller gave you, which will take you to the scammer.

Report it. If you get a call like this, tell the credit union right away. Especially if you moved money or shared a verification code. Then tell the FTC: ReportFraud.ftc.gov.

Source: United States Federal Trade Commission, www.ftc.gov

08/16/2023

We’ve recently been made aware of an increase in fake text messages claiming to be from LGE and asking the recipient to click a link.

If you receive one of these texts, do NOT click the link. Instead, forward the message to SPAM (7726) for the carrier to investigate.

iPhone users can also swipe on the text message to delete and when prompted, select “Delete and Report Junk” to report the message to both Apple and the carrier.

08/19/2022

If you own an iPhone, update to iOS 15.4.1 now to keep your device secure.

Apple recently alerted consumers to a software vulnerability that is solved by updating to the newest version of iOS. If you haven't already, update your iPhone today to protect yourself and your information.

Updates to your operating system often include critical patches and protections against security threats; setting your phone to update automatically can protect your device and provide peace of mind. Click below for information and assistance.

05/20/2022

Did you get a text from your own number? That's a scam.

How does the scam work? In one version, you’ll get a text thanking you for paying your bill with an offer to get a gift — just click on a link. Don’t click. Clicking could expose you to scams, download malware, or get your phone number added to lists that are then sold to other scammers.

To learn how to stop these messages from reaching you (or how to report them if they do), click here.

12/21/2021

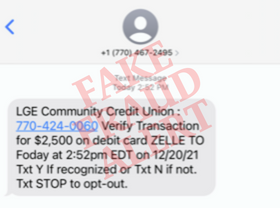

Recently some members have reported receiving fraud alert texts asking them to verify a Zelle® transaction for a large amount. This fraud alert is NOT from the credit union.

These messages are coming from fraudsters. Once the member responds to the fraud alert text, they will receive a call that appears to be from the credit union using call spoofing. The fraudsters, pretending to be LGE employees, will ask for account information. If successful, they begin sending money out of the member’s account to their account via Zelle®.

Example text message

Here are a few things to remember if you receive a text that claims to be from LGE:

- LGE representatives will NEVER call, email, or text you asking for personal information (Social Security Number, PIN, account number, card number, password, username or one time passcode).

- Don’t click any links or phone numbers in the text message. Instead, exit the text and call LGE directly at 770-424-0060.

- Remember to check your account daily and report any unusual activity.

03/16/20

Members should be mindful of COVID-19 or coronavirus phishing emails that disguise themselves as coming from the Center for Disease Control and Prevention (CDC) and the World Health Organization (WHO). WHO emails are addressed from ‘who.int’ and CDC emails end in ‘cdc.gov’.

11/15/19

Our number is being spoofed by fraudsters who are targeting our member's one-time verification codes. Do not provide your verification code to anyone. LGE will never call and request the code. Your mobile device is the only place this code should be provided. Additional information about number spoofing is provided below.

06/12/19

Protect Yourself from Call Spoofing

LGE Community Credit Union will never contact our members on an unsolicited basis to ask for confidential information such as your account number, debit or credit card number, social security number, or any account PINs, passwords, and/or access codes. If you ever receive a suspicious call or email, contact us at 770-424-0060 to let us know.

A unique type of technology enables fraudsters to fake the number they are calling from by making a false number appear on your caller ID. It’s extremely effective, because the number displayed appears to be LGE’s correct contact number.

This scam is called number spoofing, and here’s how it works: criminals clone the actual telephone number of an organization they want to impersonate. Using specialized technology, the number appears on the victim's caller ID display.

Then, when you answer the call, they often pose as credit union staff, police officers or other trusted organizations in order to persuade you to disclose sensitive financial and personal details – often on the pretense that fraud has been detected on your account.

In many cases – because a well-known precaution for phone scams is to hang up and initiate the phone call yourself – the criminal will ask you to call the credit union on the number on the back of the card (the same number displayed on your handset). But instead of terminating the call on their end, the fraudsters simply keep the phone line open, play a fake dialing tone and pretend to answer your “call.”

Having convinced you of their legitimacy, they will then ask you to move money to a secure account, or in some extreme cases, hand your debit or credit cards over to a courier.

The best advice to beat the scam is simple – never assume that someone is who they say they are just because the number displayed on your caller ID matches that of an organization you know. Always be suspicious if you’re asked for your four-digit PIN or full online credit union passwords. Same goes for transferring or withdrawing money or giving your card to a courier. Remember, LGE will never ask you to do any of these things.

08/24/2018

Recently, you may have seen news circulating about an “ATM cash-out” scheme where cybercriminals use phishing techniques and malware to access member card data, gain network access, and alter security controls, allowing them to use stolen card information to withdraw unlimited amounts of cash from the financial institution's ATM. LGE maintains sophisticated security measures to protect against such attacks, and is continually monitoring, and adapting to, the constantly evolving world of cyberattacks.

However, there are a few things you can always do as a member to stay safe online.

- Set up Online Banking Access alerts.

- Pay close attention to your account statements for unauthorized transactions.

- Learn how to avoid falling victim to spam and phishing at https://staysafeonline.org

Remember, LGE will never contact our members on an unsolicited basis to ask for confidential information such as your account number, debit or credit card number, social security number, or any account PINs, passwords, and/or access codes. If you ever receive a suspicious call or email, contact us at 770-424-0060 to let us know.

Be aware that LGE never provides a link inside an email that asks you for any personal financial information. To access your personal financial information, you should only log on to Online Banking from our website.

09/08/17

Information regarding Equifax’s data breach:

Equifax has reported that a data breach at the company may have affected 143 million Americans, jeopardizing Social Security numbers, birth dates, addresses and some credit card numbers as well as some driver’s license numbers. The breach occurred from mid-May through July 2017.

Equifax has set up a specific website to help consumers find out if their information has been exposed. The company says it is also sending notices in the mail to consumers whose credit card numbers and/or dispute documents were exposed.

In addition to the website, Equifax is also offering consumers the option to sign up for credit file monitoring and identity theft protection — as part of its TrustedID Premier offering — which includes:

- 3-bureau credit monitoring of Equifax, Experian and TransUnion credit reports;

- A copy of your credit report from the three major credit report bureaus: Equifax, TransUnion, Experian;

- The ability to lock and unlock your Equifax credit report without charge;

- Identity theft insurance;

- Web scan to monitor any use of your social security number.

The offer is completely free to U.S. consumers for one year.

The dedicated website also provides more information on ways consumers can protect their personal information, as well as ways to contact the company, including a dedicated call center that’s open seven days a week from 7:00 a.m. to 1:00 a.m. ET. That number is 866-447-7559.

The most effective way to protect yourself from identity theft is with a credit freeze. A credit freeze allows you to seal your credit reports and use a personal identification number (PIN) that only you know and can use to temporarily “thaw” your credit when legitimate applications for credit and services need to be processed. The added layer of security means that thieves can’t establish new credit in your name even if they are able to obtain your personal information.

Freezing your credit files has no impact whatsoever on your existing lines of credit, such as credit cards. You can continue to use them as you regularly would even when your credit is frozen. Click here for instructions on freezing your credit.

Tips to protect yourself from online scammers:

- Be wary of unexpected emails containing links or attachments: If you receive an unexpected email claiming to be from your bank or other company that has your personal information, don’t click on any of the links or attachments. It could be a scam. Instead, log in to your account separately to check for any new notices.

- Call the company directly: If you aren’t sure whether an email notice is legit, call the company directly about the information sent via email to find out if it is real and/or if there is any urgent information you should know about.

- If you do end up on a website that asks for your personal information, make sure it is a secure website, which will have “https” at the beginning (“s” indicates secure).

- Look out for grammar and spelling errors: Scam emails often contain typos and other errors — which is a big red flag that it probably didn’t come from a legitimate source.

- Never respond to a text message from a number you don’t recognize: This could also make any information stored in your phone vulnerable to hackers. Do some research to find out who and where the text came from.

- Don’t call back unknown numbers: If you get a missed call on your cell phone from a number you don’t recognize, don’t call it back.

05/30/17

We would like make you aware of a recently discovered data breach at Docusign, the electronic signature vendor for LGE documents. So far, the breach seems to have only affected users who elected to create a Docusign account when prompted to sign documents electronically through Docusign. If you did create an account, your name and email address may have been compromised, making you vulnerable to phishing emails in attempts to gather more personal information. To combat this threat, we would like to remind you that LGE will never send you anything through Docusign without a prior conversation with a loan officer or member service representative. We also never ask you to verify any personal information by email.

Your financial well-being is always our top priority and your personal information entrusted to LGE was never exposed or compromised. Please visit Docusign’s website created for this breach for updates: https://trust.docusign.com/en-us/personal-safeguards/

01/17/17

Download your mobile applications, particularly LGE Mobile apps, from Google and Apple only. Any other source is unauthorized, may compromise your device, and/or lead to fraud against your accounts.

12/20/16

Ensure you are not using the same passwords for Online Banking that you would use with your email account at Yahoo. Yahoo recommended that its customers use Yahoo Account Key, an authentication tool that verifies a user’s identity using a mobile phone and eliminates the need to use a password on Yahoo altogether.

03/10/16

Is your mobile device secure? Click here to download tips for securing your mobile device.